For those yearning for guaranteed getaways without the hefty price tag of full-fledged vacation home ownership, timeshares offer an intriguing proposition. But what exactly are timeshares, and how do they work? This article delves into timeshares, exploring their core concept, operational mechanisms, and the various ownership structures available.

Timeshares is an intriguing blend of vacation luxury and shared ownership that epitomizes a modern approach to holiday accommodations. It doesn’t grant you traditional property ownership. Instead, you purchase the right to use a specific unit, typically within a resort or vacation complex, for a predetermined period each year. This period is usually a week, although variations exist. The allure of timeshares lies in securing a guaranteed vacation spot, eliminating the annual scramble for bookings and accommodations, particularly during peak seasons.

How Timeshares Operate

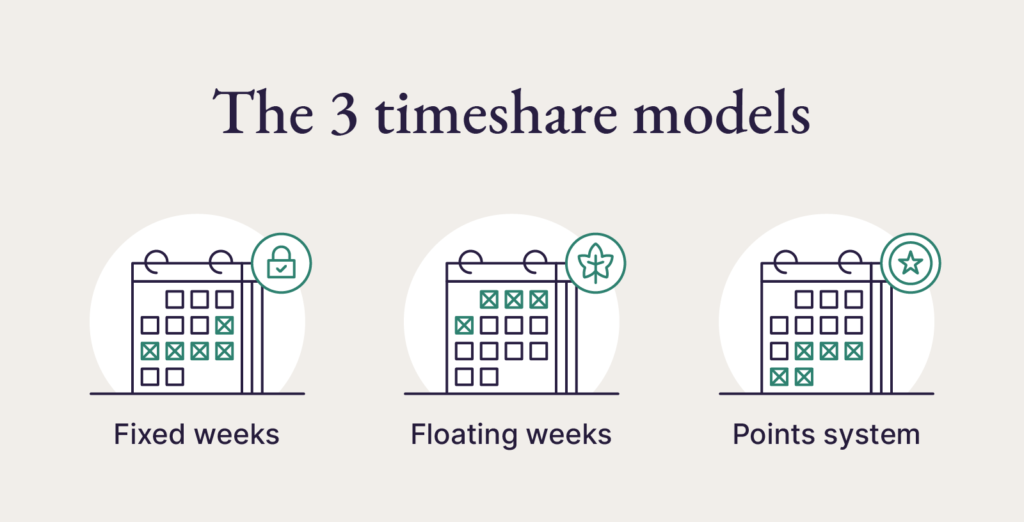

Timeshare properties essentially subdivide ownership (or usage rights) amongst multiple individuals. This allows for a more affordable way to access desirable vacation destinations. Three main ownership structures dictate how you access your allotted vacation time:

- Fixed Week: This system grants you access to the same unit during the same week each year. Perfect for those who crave routine and predictability in their getaways.

- Floating Week: This option offers more flexibility. You can choose a different week within a designated season (e.g., summer) to use your timeshare each year. Reservations are typically made on a first-come, first-served basis.

- Points-Based System: This provides the most adaptable ownership structure. You purchase a pool of points that can be redeemed for varying lengths of stay at different locations within the timeshare network. It is ideal for those who crave variety and spontaneity in their vacations.

How to Get Rid of a Timeshare

Getting rid of a timeshare can be tricky, but there are a few options you can explore.

1. Selling Your Timeshare

- Resale Market: You can try selling your timeshare on the resale market. However, timeshares can be difficult to sell, and you might not get back what you paid for it.

- Selling to the Developer: Some developers offer buy-back programs, but these are often limited and might not be available for all timeshares.

2. Deed-Back (Surrender)

Negotiate with the Resort: In some cases, you might be able to negotiate a deed-back or surrender with the resort. This means you return the timeshare to the developer, potentially in exchange for a fee.

3. Renting Your Timeshare

Offset Some Costs: You can try renting out your timeshare to generate some income to help offset the annual maintenance fees.

Advantages of Timeshares

- Guaranteed Getaways: Timeshares provides a guaranteed vacation spot each year, eliminating the stress of last-minute bookings and potentially inflated hotel rates during peak seasons.

- Familiar Comfort: Especially with fixed-week timeshares, you can return to the same unit and resort year after year, fostering a sense of familiarity and comfort, making it a true “home away from home.”

- Cost-Effectiveness (Potentially): Over multiple years, timeshares can be a more affordable way to vacation in desirable locations compared to booking hotels every year. This is particularly true if you frequent the same destination and travel during peak seasons.

- Spacious Accommodations: Timeshare units are often larger than hotel rooms, offering more space to spread out and amenities like kitchens or laundry facilities, which can be ideal for families or longer stays.

- Access to Amenities: Timeshare resorts typically offer a variety of amenities like pools, fitness centers, and on-site restaurants, often included in your ownership fees.

Disadvantages of Timeshares

- Limited Flexibility: Fixed-week timeshares lock you into the same week each year. Floating weeks offer more flexibility, but securing your preferred dates can still be challenging. Points-based systems offer the most adaptability, but navigating them requires research and planning.

- Upfront Cost and Ongoing Fees: The initial purchase price of a timeshare can be substantial. Additionally, annual maintenance fees are mandatory and can add up over time.

- Difficulty Reselling: The timeshare resale market can be saturated, and you might receive significantly less than what you paid for it when trying to sell.

- Limited Exchange Options: While some timeshare programs offer exchange opportunities to use your ownership at different resorts, these programs can come with additional fees and limitations.

- Potential for Overcrowding: Popular resorts and peak seasons can lead to overcrowding, diminishing the enjoyment of your guaranteed vacation.

FAQs

How do timeshare points work?

Timeshare points act like a flexible vacation currency. You purchase a pool of points instead of a specific week at a resort. The number of points you own determines the type of vacation you can redeem them for. More points allow for longer stays, larger units, or stays at more luxurious resorts within the network. You typically book vacations through an online reservation system, with point requirements varying based on location, unit size, and length of stay.

How can I get timeshare financing?

Timeshare purchases can be financed, but proceed with caution. Interest rates on timeshare loans can be high. Here are some options:

- Developer Financing: Some developers offer financing options, but be sure to compare rates and terms carefully before committing.

- Personal Loan: You can explore a personal loan from a bank or credit union. This might offer a more competitive interest rate than developer financing.

- Home Equity Loan/Line of Credit: If you own a home, consider a home equity loan or line of credit. However, this option puts your home at risk if you default on the loan.

How long do timeshares last?

Timeshares are typically deeded ownership for a set period, often ranging from 30 to 50 years. After that time, the ownership rights may revert to the developer according to the specific terms of the contract.

What happens if you walk away from a timeshare?

Walking away from a timeshare (defaulting on your ownership fees) can have severe consequences. Here’s what could happen:

- Debt Collection: The timeshare company will likely send you to collections, damaging your credit score.

- Foreclosure: Sometimes, the timeshare company might foreclose on your ownership, resulting in a legal judgment.

- Difficulty Selling: It can be very difficult to sell an unwanted timeshare, especially with outstanding fees.

5. Can you give a timeshare back to the resort?

Deed-back (or surrender) is an option in some cases. You negotiate with the resort to return your timeshare, potentially in exchange for a fee. However, resorts are not obligated to accept deed-backs, and there might be associated costs.

A4ARCHITECT OFFICE,

ALONG SOUTHERN BYPASS.

SOUTH HOUSE HOTEL AIRBNB – 0721410684

.

Leave a Reply