Imagine owning a slice of a giant skyscraper, a bustling shopping mall, or a cozy apartment complex – all without the hassle of leaky faucets and mountains of paperwork. That’s the magic of Real Estate Investment Trusts or REIT. They’re like tiny treasure chests holding income-producing properties, offering you a piece of the action without the burden of becoming a full-fledged landlord.

What is a REIT?

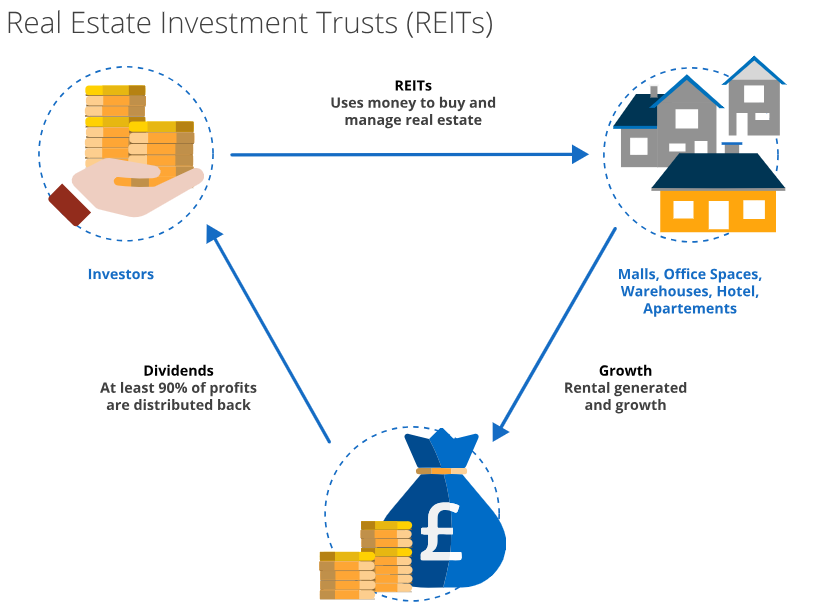

A REIT is a company that owns, operates, or finances income-generating real estate ventures. Like a mutual fund, a REIT pools capital from multiple investors and uses it to acquire and manage a diverse portfolio of properties. Investors gain exposure to the real estate market by purchasing shares in the REIT, much like buying stocks.

Types of REITs

- Equity REITs (E-REITs): These are the most common type, and they own and operate income-producing real estate. They generate income from rents and potentially benefit from property value appreciation.

- Mortgage REITs (M-REITs): M-REITs don’t own physical properties. Instead, they invest in mortgages and other real estate-related debt instruments. Their income comes from the interest earned on these loans.

- Hybrid REITs: As the name suggests, these REITs combine elements of both E-REITs and M-REITs. They may generate income from a mix of property ownership and mortgage financing.

- Development REITs (D-REITs): D-REITs focus on acquiring land, developing properties, and selling them for a profit. They offer the potential for higher capital appreciation but may

How to Invest in a RIET

1. Define your Investment Goals

Before diving in, clearly define your investment goals. This can either be;

- High Current Income: Prioritize REITs with a strong history of high dividend payouts. Equity REITs (E-REITs) typically offer stronger dividends than Mortgage REITs (M-REITs).

- Long-Term Growth: Focus on REITs with a track record of capital appreciation in their underlying properties. Consider factors like the current market value and potential for future growth.

2. Choose Your Investment Vehicle

There are three main ways to invest in REITs:

- Individual REIT Shares: This allows for the most control, letting you pick specific REITs based on your research. You can buy shares of publicly traded REITs on major stock exchanges like any other stock.

- REIT Mutual Funds: These pool your money with other investors and invest in various REITs. This offers instant diversification and reduces portfolio risk compared to individual REITs.

- REIT Exchange-Traded Funds (ETFs): Similar to mutual funds, REIT ETFs hold a basket of REITs. However, ETFs trade throughout the day like stocks, offering greater flexibility and potentially lower fees.

3. Research and Analyze

For Individual REITs: Look at factors like the REIT’s type (E-REIT, M-REIT, etc.), their portfolio composition (property types, geographic location), dividend history, payout ratio (percentage of income paid as dividends), and management team experience.

For Mutual Funds and ETFs: Analyze the fund’s investment objective, expense ratio (fees), historical performance, and holdings diversification. Utilize financial websites and resources to compare and evaluate different options.

4. Open a Brokerage Account (if needed)

If you plan to buy individual REIT shares or ETFs, you’ll need a brokerage account. Online brokers offer a convenient way to buy and sell investments. Research different brokers to find one that aligns with your needs and fees.

5. Invest and Monitor

Once you’ve chosen your REIT investment, make your purchase through your chosen platform. Remember, investing is a long-term game. Regularly monitor your REIT holdings and the overall market, and be prepared to adjust your strategy as needed.

What Qualifies As a REIT?

To qualify as a Real Estate Investment Trust (REIT), a company must meet specific requirements set by the Internal Revenue Code (IRC). These requirements ensure that REITs operate in a way that benefits both investors and the real estate market. Here’s a breakdown of the key qualifications:

Investment Focus

- Real Estate Centric: At least 75% of the REIT’s total assets must be invested in real estate ventures. This could be direct ownership of properties (equity REITs) or financing real estate projects through mortgages (mortgage REITs).

- Income Source: At least 75% of the REIT’s gross income must come from real estate-related sources. This includes income streams like:

- Rents collected from tenants in properties they own (equity REITs)

- Interest earned on mortgages they hold on real estate projects (mortgage REITs)

- Gains from selling real estate assets

Distribution Mandate

Sharing the Profits: REITs are obligated to distribute at least 90% of their taxable income to shareholders as dividends each year. This rule encourages them to generate income and pass it on to investors, making them attractive to those seeking regular income.

Structure and Management

- Taxable as a Corporation: REITs are generally structured as corporations and taxed as such. However, the 90% dividend distribution rule allows them to potentially avoid paying corporate income tax on that distributed income.

- Board Oversight: REITs must be managed by a board of directors or trustees who oversee the company’s operations and investment decisions.

Shareholder Base

- Minimum Shareholders: A REIT must have at least 100 shareholders to qualify for the tax benefits. This ensures the company is publicly traded and accessible to a broad range of investors.

- Public Ownership: No more than 50% of the REIT’s shares can be held by five or fewer individuals. This prevents the REIT from becoming a closely held company and ensures wider investor participation.

Advantages of REITs

- Accessibility: REITs provide a low barrier to entry compared to directly buying properties. You can invest in smaller amounts and avoid the complexities of property management.

- Diversification: REITs allow you to spread your investment across various property types, mitigating risk associated with a downturn in a specific sector. They offer exposure to residential, commercial, healthcare, industrial, and more.

- Passive Income: REITs are known for their regular dividend payouts, providing a steady stream of income that can be particularly attractive for retirees or income-seeking investors.

- Potential for Growth: Along with dividends, REITs offer the potential for capital appreciation as the value of their underlying properties increases over time. This allows for long-term wealth creation.

- Liquidity: Unlike directly owning real estate, REITs are generally highly liquid. You can easily buy and sell shares on major stock exchanges.

- Professional Management: REITs are managed by experienced professionals who handle property selection, acquisition, and management. This frees you from the burden of those tasks.

Disadvantages of REITs

- Market Volatility: Like any stock, REIT share prices can fluctuate based on market conditions. This can lead to potential losses if you sell during a downturn.

- Interest Rate Sensitivity: REITs, especially those reliant on mortgage revenue (M-REITs), can be sensitive to changes in interest rates. Rising interest rates can make it more expensive for them to borrow money, potentially impacting their profitability.

- Limited Control: As an investor in a REIT, you have little control over the underlying properties or management decisions. You rely on the REIT’s management team to make sound investment choices.

- Tax Implications: While REITs themselves are generally exempt from corporate income tax on distributed dividends, these dividends are taxed as ordinary income for investors. This can be less tax-favorable compared to qualified dividends from stocks.

- Fees: REITs typically charge management fees and other expenses, which can eat into your returns. Be sure to factor these fees into your investment analysis.

Conclusion

REITs are a gateway to the exciting world of real estate investing, minus the complexities of direct property ownership. They offer the potential for steady income, long-term growth, and diversification, making them a valuable tool for building wealth. So, if you’re looking to add a touch of real estate magic to your investment strategy, consider exploring the world of REITs. With careful research and a well-defined plan, you can unlock the potential for a prosperous future, brick by brick.

A4ARCHITECT OFFICE,

ALONG SOUTHERN BYPASS.

SOUTH HOUSE HOTEL AIRBNB – 0721410684

Leave a Reply