Ever dreamt of owning a beachfront villa in Bali or a ski chalet in the Alps, but the price tag sent shivers down your spine? Fractional ownership might be your golden ticket to luxury living without breaking the bank.

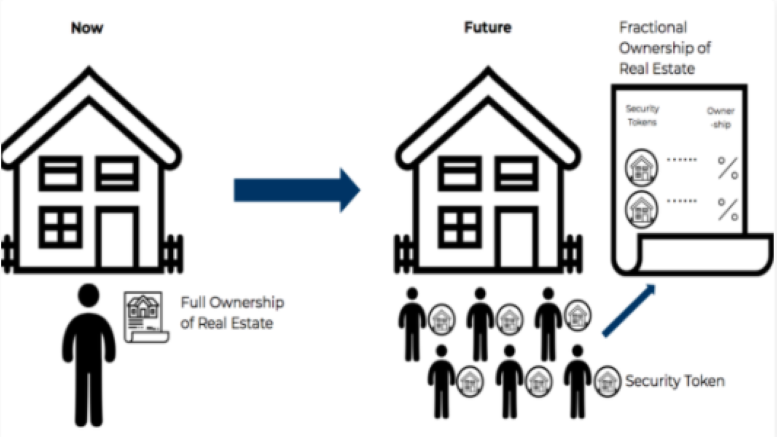

In today’s dynamic economy, the concept of ownership is evolving rapidly. One innovative model gaining traction is “Fractional Ownership,” a system that democratizes access to high-value assets by allowing multiple individuals to own a share of an asset, rather than requiring one person to bear the full financial burden. This model is reshaping industries ranging from real estate to luxury goods and even fine art.

What is Fractional Ownership?

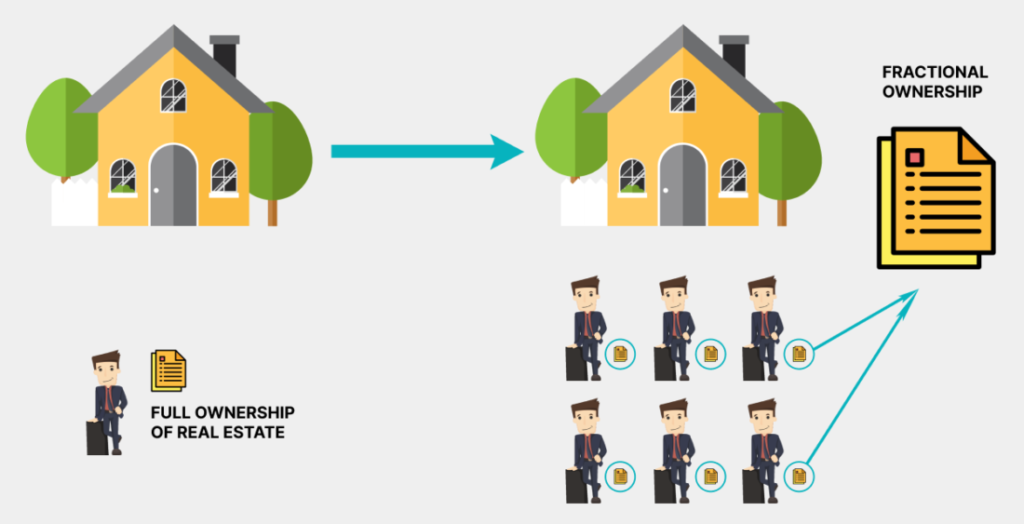

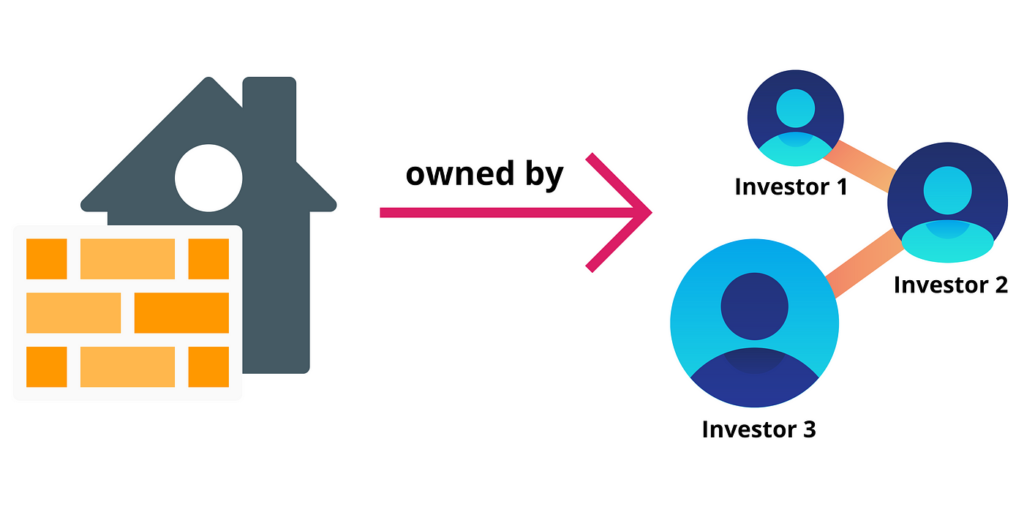

Fractional ownership is a method where multiple unrelated parties can share in the ownership of a tangible or intangible asset. Each owner holds a fraction, or percentage, of the asset, proportionate to their investment. This allows individuals to enjoy the benefits and privileges of ownership without the need to purchase the asset outright fully.

How Does It Work?

The mechanics of fractional ownership are relatively straightforward. An asset—say, a vacation home—is divided into several shares. Interested buyers can purchase one or more of these shares, entitling them to a portion of the asset’s use, profits, and responsibilities. This division of ownership is typically managed through a legal structure, such as a limited liability company (LLC) or a trust, which ensures that all parties’ rights and obligations are clearly defined and protected.

Advantages

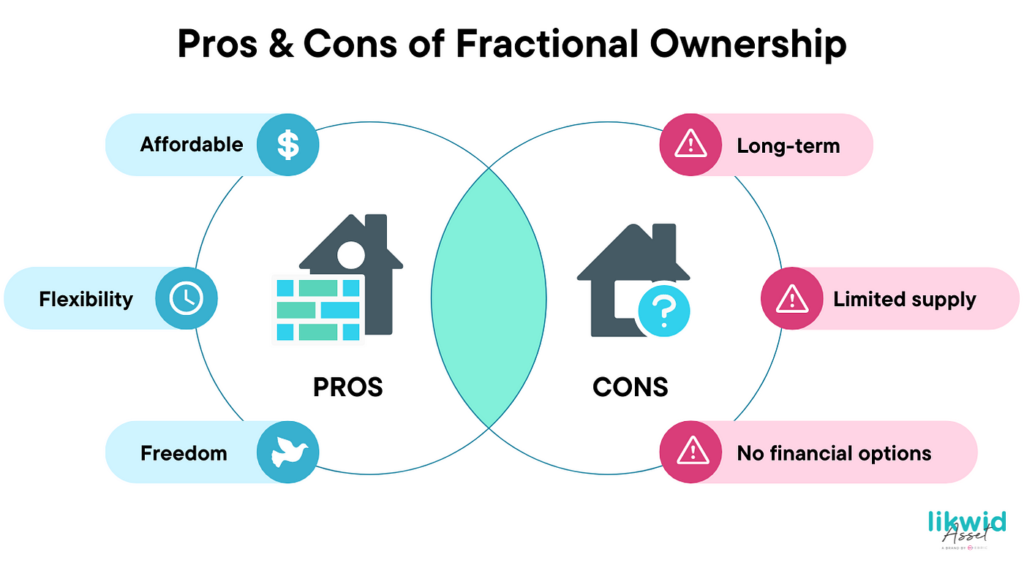

- Cost Efficiency: The most compelling advantage is the reduction in individual financial outlay. High-value assets like yachts, private jets, or luxury properties become accessible to a broader audience. This reduces risk and billions for greater individual flexibility.

- Diversification: Investors can diversify their portfolios by owning fractions of multiple assets rather than investing heavily in a single asset.

- Flexibility: Fractional ownership provides more flexibility than traditional ownership. Owners can enjoy the use of the asset for a predetermined amount of time each year. In addition, some programs allow usage points that can be exchanged for different assets within the fractional ownership company’s portfolio.

- Reduced Management Hassles: In most fractional ownership structures, a management company handles the upkeep, maintenance, and scheduling of the asset. Therefore, alleviating these burdens from individual owners.

- Potential for Appreciation: As with any ownership, there’s the potential for the asset to appreciate over time. Therefore, fractional owners would benefit proportionately to their share ownership.

Disadvantages

- Less Control: Fractional owners share decision-making authority and usage schedules with other owners. This can be a challenge if there are disagreements about how the asset is used.

- Potential for Illiquidity: Fractional shares may not be as easy to sell as whole assets, especially if there’s a limited market for that particular type of fractional ownership.

- Management Fees: Management companies typically charge fees for their services, which can reduce the overall return on investment for fractional owners.

Is Fractional Ownership Right for You?

Fractional ownership can be a compelling option for individuals who want to access high-value assets, diversify their portfolios, and benefit from shared ownership. However, it’s important to carefully consider the potential drawbacks, such as reduced control and potential illiquidity, before making an investment.

Industries Embracing Fractional Ownership

- Real Estate: Vacation homes and investment properties are prime candidates for fractional ownership.

- Aviation: Companies like Net Jets offer fractional ownership of private jets, providing the convenience of private air travel at a fraction of the cost.

- Marine: Yacht-sharing services enable enthusiasts to co-own luxury boats, making sailing more accessible and financially viable.

Challenges and Considerations

While fractional ownership presents numerous benefits, it is not without challenges. Legal complexities, management disputes, and liquidity issues can arise. Prospective investors should conduct thorough due diligence and consider working with reputable platforms that offer transparent terms and robust governance structures.

Conclusion

Fractional ownership is transforming how we think about asset acquisition and investment. By breaking down financial barriers and offering flexible, diversified options, it is making luxury and high-value assets accessible to a wider audience. As this model continues to mature, it promises to further democratize ownership and reshape various industries. This enables more people to partake in the benefits of owning premium assets.

A4ARCHITECT OFFICE,

ALONG SOUTHERN BYPASS.

SOUTH HOUSE HOTEL AIRBNB – 0721410684

Leave a Reply