Joint venture financing is increasingly becoming an option of choice for most land owners and real estate financiers due to its simplicity.

The land owner comes up with the land while the financier comes up with funding to construct then after construction, the financier sells off units to cater for the construction cost and profits and the land owner remains with their units which they can sell or rent out for monthly income.

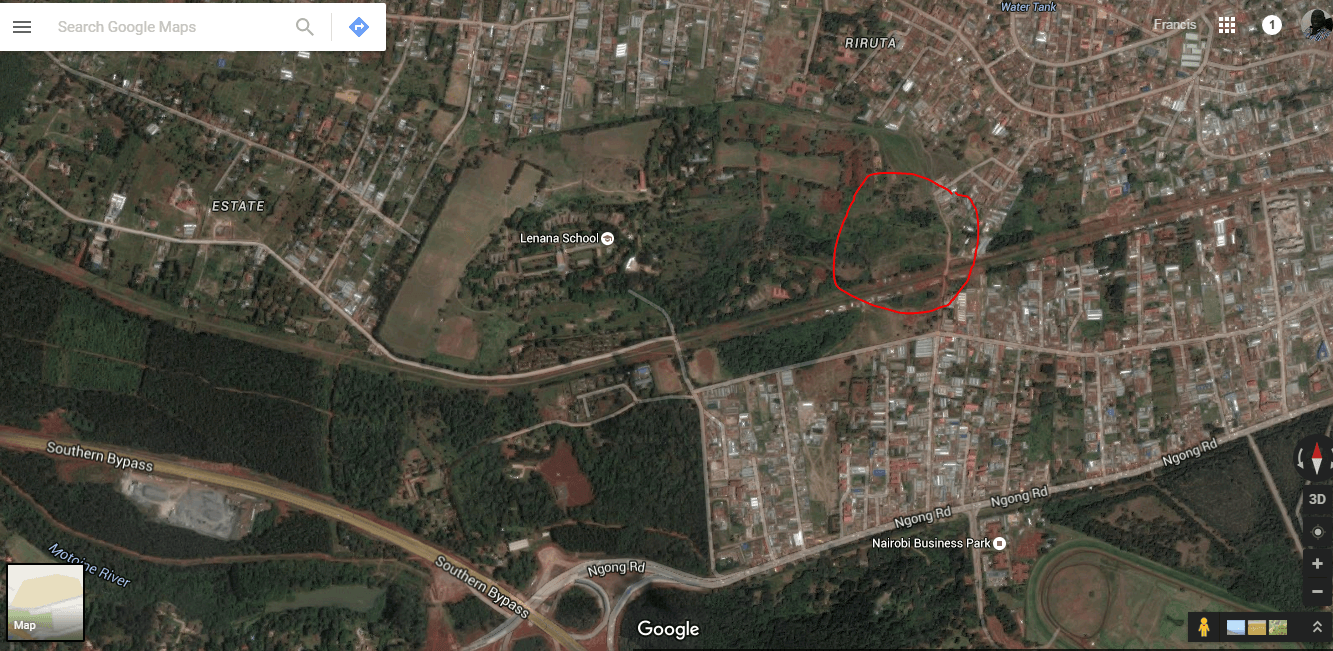

The proposed land size is 10 acres bordering the railway near Riruta side.

Lenana school area.

This area borders Riruta and Ngong road. Its approximately 11 km from the Central Business District of Nairobi. similar distance with Kasarani, Thindigua,Imara Daima, Donholm estates around Nairobi.

Land value. An estimated value of kes 100,000,000 per acre will be used for the calculations.

Architectural design.

The Lenana area is upper middle class zone so the construction will be estimated for this type of quality of house.

960 Units of 2 bedroomed can be constructed, costing kes 5 billion.

At a sale price of kes 8.8 million per 2 bedroomed unit, the total sale value will be kes 7.6 billion.

Profit sharing.

Out of the 960 units constructed, the land owner is set to gain at least 249 units. The land owner can choose to rent or sell their units as they with. The profits can be ploughed back into any good use as the land owner may deem fit.

Conclusion.

Joint venture for construction of high rise apartments provides a good method of utilizing vertical space . Land is a horizontal quantum, of which the vertical quantum can be utilized to infinity…or just 8 floor levels like in the proposed housing estate.

Utilization of the vertical quantum enables unlocking of vast financial resources that can go a long way in sorting out the land owner’s day to day activities. Outright sale of 10 acres will yield at least kes 1 billion. Joint venture financing will yield at least kes 2.1 billion and has the added advantage of being used for recurrent rental income of at least kes 10 million per month in perpetuity.

This brings out the beauty of joint venture financing in that the land owner only provides unencumbred land and then sits back to gain at least kes 10 million per month of kes 2.1 billion in cash as per the calculations.

Architect Francis Gichuhi kamau.

info@a4architect.com

Leave a Reply